What Is A MIC?

A Mortgage Investment Corporation, also called MIC is a financial organization that handles mortgage financing and investments in Canada. By pooling investors capital, the MIC manages a diversified portfolio of mortgages similar to traditional bank mortgage financing but instead of the bank earning interest, you do.

Specialize In

Residential

Commercial

Development

What Type Of Borrower Utilizes Funds From A MIC

There are many advantages of borrowing from MMIC instead of from a bank. MMIC is able to provide funds on short notice to its borrows providing interest only payments. Generally these are short term 12 month loans and allows individuals to act on short closing and lucrative properties.

Borrowing from friends and family can be beneficial but can also add strain to relationships and may limit your recourses. Here at MMIC we provide our borrowers another alternative with quick turn around times and access to larger pool of funds.

In todays competitive real estate market having access to funds on short notice is a must. Here at MMIC we are able to provide borrowers with funds on short notice to take advantage of quick closes without large cash outlays.

Frequently Asked

Questions

MICs are strictly regulated by several governing bodies, including the Canada Revenue Agency, Ministry of Finance and British Columbia Securities Commission. These regulations require an annual financial statement audit by an independent accounting firm. The Income Tax Act of Canada requires the distribution of 100% of a MICs annual net income and therefore MICs pays no corporate tax. The MIC is a flow-through vehicle.

One of the biggest benefits of working with a private lender is they operate differently from traditional banks on many levels. Since they get their money through individual investors or groups of investors, they have the freedom to set their own lending criteria. This means they are more flexible in the application process and don’t have to deal with the stringent guidelines set forth by the major institutions. This means that if your situation falls outside conventional lending guidelines, a private mortgage could be your best bet.

-

- Are self-employed

- Want to purchase raw land or unique property

- Have less than ideal credit

- Want to invest in real estate

- Need access to equity in your home, but don’t want to refinance your first bank mortgage due to excessive penalties

- Need to consolidate high interest rate debt

- Are looking to renovate existing property

- Looking for a short-term loan

Minimum initial investment is $25,000 CDN. Subsequent investments do not have a minimal requirement.

Yes, we provide financing on a variety of development and commercial properties including but not limited to land and land assembly for stacked townhomes, traditional townhomes, duplexes, single detached homes, low-rise and mid-rise conidium’s throughout the lower mainland.

No, MMIC has funded projects on both Vancouver Island and the Okanogan. Our lending committee will review the file and make a decision accordingly. However, MMIC does not lend outside of BC at this time.

Yes, generally an appraisal is required on a property before MMIC will lend on a property. At this time we do not have an approved list of appraisers, please reach out to Barinder Sekhon our Senior Underwriter for more information.

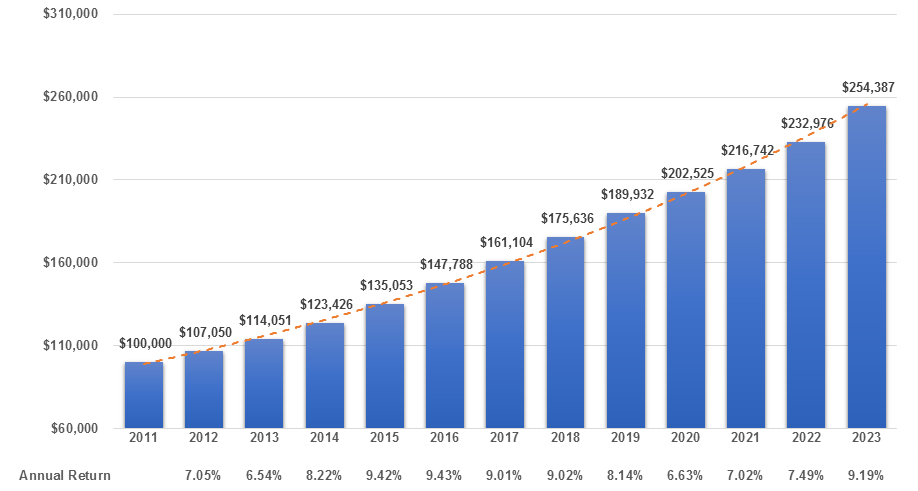

Metropointe MIC Results

Investment Growth Of $100,000 Investment